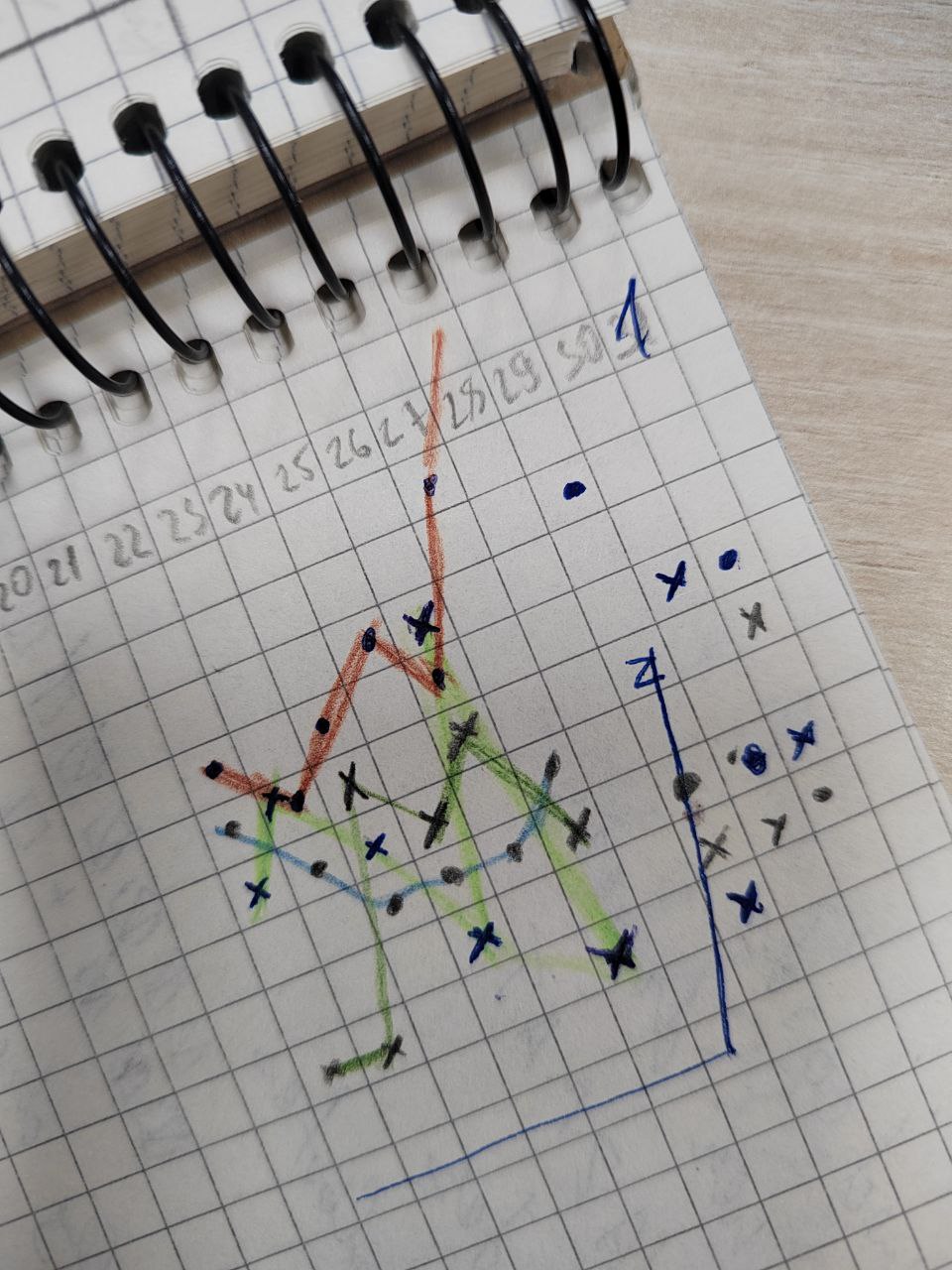

If you would like to figure out what these posts are about and why they have the most basic things mentioned, like skipping a latte, please read the first post. If you don’t want to do that, in a couple of words: spending money is not a lack of knowledge problem around here, it’s a mood disorder problem. Now that I’m sufficiently medicated, I’m almost a tightwad.

Moving on.

This is a long post, go make yourself a cuppa.

In May I was laid off from my job of 2 years. I still have not secured gainful employment, which means I don’t really go anywhere, so all my thrift revolves around shopping for the necessary consumables. There are some deviations from this category, but there aren’t many.

My job interview process started strong, but so far there hasn’t been any favourable (as in ‘job’) result. Two interviewers told me I was a perfect match, but since I have surgery coming up, they suggested I take care of that first, and then contact them again to start onboarding. The issue here is that I don’t know the date of the surgery, and to be able to get surgery I need to be employed, because I need to be insured.

So it’s a fucked up circle. I need surgery out of the way to get a job. I need a job to have insurance. I need insurance to have surgery. I need surgery out of the way to get a job, etc. etc. I almost want to start keeping silent about it, honestly. Maybe then I’d be able to get it all done. Whoever said that honesty is the best policy never tried to navigate a modern capitalist society.

Anyway, back to thrift.

1. I bought butt-scratching cheap toilet paper. I am not pleased. My imperial arsehole deserves better.

2. I resisted soft drinks with all my might, and only caved in three times.

3. I bought a big tube of ice-cream instead of small portioned ones. There’s nothing wrong with the big tube (tube, not tub, yes, the cheapest ice-cream is sold in big plastic tubes/ bags here, they are soft and long, that’s what she said, whatever), it’s just a sensory issue. I have to portion it out by cutting with a knife, and it is simultaneously sticky and freezing, and just ugh.

4. I’m still not buying laundry detergent, because I still have things to wash my laundry with. I wonder if I’ll still be mentioning this in 2026.

5. I unsubscribed from pretty much everything paid by this point, except Netflix (it’s shared with a person I am not quite ready to explain my situation to), Yandex (suddenly I started listening to a lot of audiobooks, and it gives me access to thousands for $2), Google (I have no other place for my 1TB of photos), and Adobe Lightroom (because to cancel the subscription entirely would be a ‘breach of contract’ and would cost me $180). First one to go in this list would be Lightroom. Once my yearly contract ends – October, I think – I will let it go and use other programmes to edit. I’m actually so pissed at Adobe for their recent changes to privacy policy (google, it’s all over the internet), I haven’t even opened Lightroom since. But I can’t afford the $180 cancellation fee. There are some yearly subscriptions that cost about $2-3 per year. I am not letting these go, because they are worth it for me.

6. I did not go out and buy 1-2 ‘smart casual’ outfits. They would have been second-hand and I would have looked for as inexpensive as possible, but no expenditure at all is still cheaper than the least expensive purchase. The surefire way to double your money is to fold it in half and put it back in your wallet, or whatever.

But yes, let’s extrapolate as to why I wanted ‘smart casual’ outfits in the first place, when the thought alone in the direction of anything ‘smart casual’ makes me shudder. One of the companies I interviewed for has a dress code. I made it do for the interview, but if I were to go there 5 days a week, I would need at least one change of clothes – thankfully I’m not particularly sweaty. They told me that I would start training shortly, but it fell through.

7. Since then I took stock of all the clothes that I have that currently fit me, and realised that I might get away with purchasing two polo t-shirts, and that would be enough for a ‘smart casual’ wardrobe for the work week. Take stock, people. It’s an incredible money and space saver.

8. I walked pretty much everywhere. My car broke down again (more on that below), and I don’t have a mass transit card. I think I will get a 6 months one soon, though. When you’re unemployed these seemingly painless charges of 30 euro cents here and there add up really quickly. So the only time I used public transportation was to one interview that was a little further away (it was hottt, and I didn’t want to look disheveled upon arrival) and to and from my old job to pick up my stuff.

9. I restarted my savings jar. It saved me many times before, because when you have 0.5 in your bank account, even a fiver in the savings jar feels luxurious. It doesn’t have much in it currently, but even 1 is better than 0.

10. I decided to sell my car. It might take a while, and I might do it all wrong, because I’ve never sold a car before. But I’m done. When she broke down on me on my last day at my job, I felt betrayed. Considering everything else that went down, I’m not surprised I felt that way. Dramatic, but true.

Why is selling car a frugal move, you ask? Well, petrol is more expensive than mass transit. I also keep needing to repair Ruby (car) all the time, because she’s an older model. And most of the jobs with night shifts here pay for your transportation to or from work, depending on the schedule. It’s just that my old company was one of the few that did not. So provided that I don’t ride taxis every time I need to go somewhere – and I won’t, I’m really only inclined to do that when I’m dead tired or really late or in pain, I actually dislike cabs – the ‘transportation’ line in my budget sheet will see a significant decrease.

But it will be a while, I’m sure. I’ll keep you posted. I’m also not sure what I will do with that money once I have it. To say more is to reveal too much, so I will keep silent on this matter.

11. I am looking into refinancing my existing debt. This, if achieved, will nearly halve my monthly payments. I’m not really looking into interest right now, but seeing as some of that debt is NBFIs, the interest will probably stay about the same overall. Considering how much of that debt I have, banks are actually really interested. So cross your fingers for me. Succeeding here will allow me to expand my job search as well, because I would be able to look at positions with smaller salaries.

12. I lost weight, and plan to continue in that direction. Keeping your weight in check is a frugal move, because obesity comes with tonnes of (deadly and expensive) complications. You also eat less. And your clothes cost less.

13. Unrelated to my weight loss – as in, I’m not doing it with that goal in mind, but I’m sure it contributed a bit – I’ve been eating 2 meals a day and a snack most days. Summer is here and I’m just not hungry. Pretty sure the effects of this meal cut would have been much more dramatic, but that snack? Is a huge bowl of ice-cream eaten under the AC. Lord I hate the heat. And it’s not even the dog days yet. Anyway, all that ramble is to say that this affects my food bill. I don’t spend much on food these days.

14. I only keep the AC on for a couple hours a day, when the sun hits my windows directly and drives me (and cats) up the walls – or rather, into the deepest darkest parts of the flat. Cursed be the people who gave orders to cut down the trees that protected my windows from the sun.

15. I am creative with my cooking. So creative, I’m actually considering making another post for this point exclusively. It pays to not being a picky eater and have an overall preference for bland foods, let me tell ye. But even if you don’t like bland, spices and condiments are cheap and will take you far.