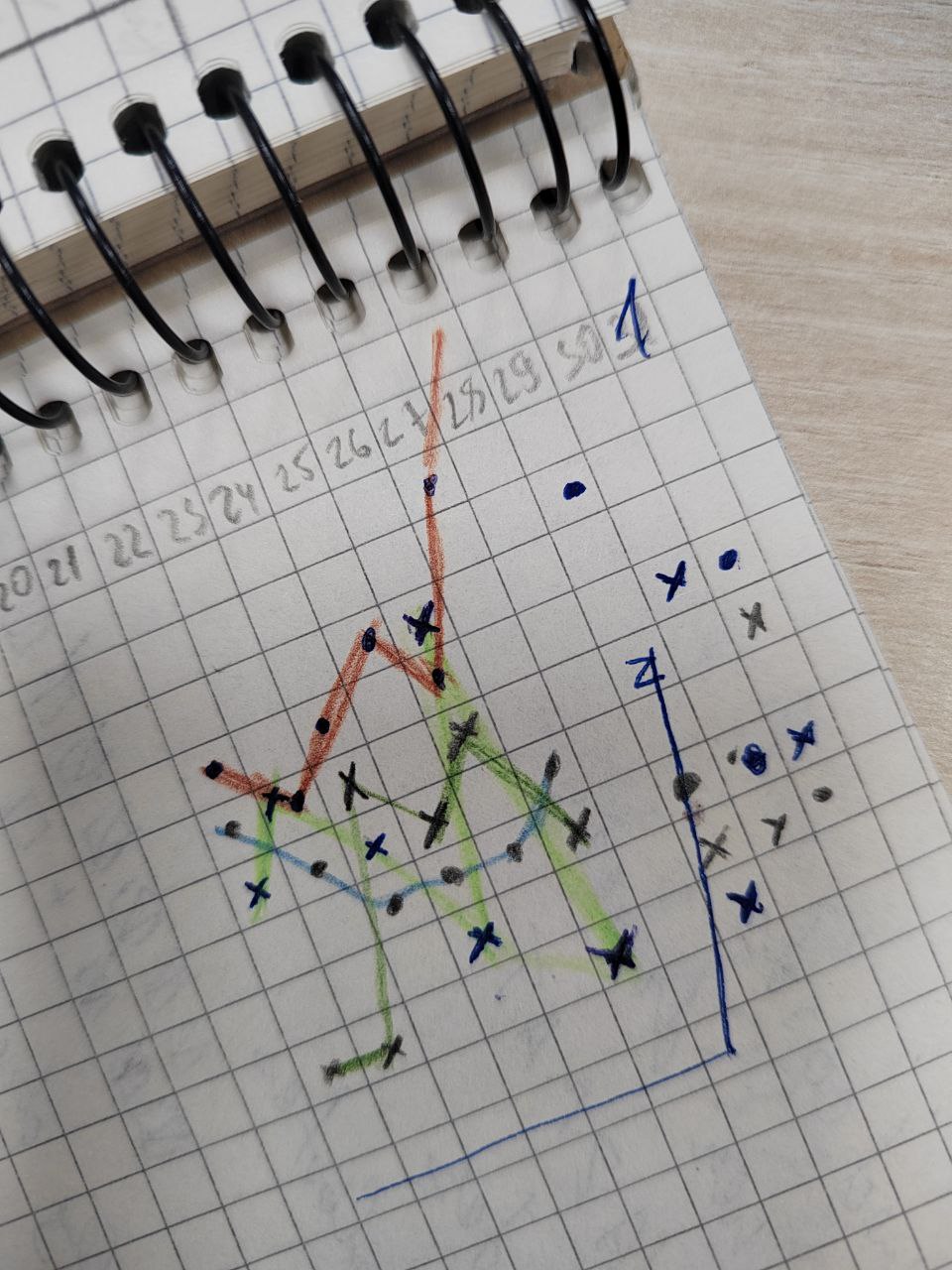

I was really discouraged in April. I am still discouraged in May. And today I looked at June, and I’m even more discouraged now. Is there really any need for me to be writing these posts, where it seems like anything I do simply does not work?

But I guess, forced by circumstance or actual healthy reasoning, some of my choices are changing. Even today I came to the office, and my first impulse was to go get a take-out coffee. Doesn’t matter that I have 7 euro left to my name (yes, 10 days into the month, one week after salary).

But I didn’t do it. I didn’t get that coffee.

Though obviously one coffee is not going to save me from financial ruin.

So what else did I do?

If you’re new to these posts, please read the first couple paragraphs of the month of February. If you’re of the lazy kind, then at least know this: I know how to save money. I don’t need advice. If I implemented every single money saving tip I know, I’d be one rich motherfucker by now. Unfortunately I am not exactly right in the head, so it is what it is. We’re working on it.

1. I’ve got a whole kitchen set up in the office, I’m telling you. Cooking at home continues to be difficult, and my pancreas doesn’t like to subsist on ramen and crackers (who’d have thought, huh). So I bought a bunch of instant porridges and flakes, a big tub of yoghurt, some pre-washed veg, and garlic salt, and this is my lunches most days. Breakfast is a supermarket muffin that is sometimes accompanied by a cheese sandwich. Supper is eggs or beans on toast. This has allowed me to almost completely avoid the deli counter, obliterate take-out, and minimise bakery visits.

2. I brought water from home. Sometimes people responsible for office water delivery forget to order it on time, and we run out before fresh bottles arrive. I used to buy a bottle in these cases, but this time around I brought a big-ass bottle from home. And I filled it with boiled water.

3. Speaking of water, my father bought a new electric kettle. I don’t really want to get into the whole story – and yes, there is one. But my stove-top kettle is out of business once more. I can’t deny the convenience of an electric one.

4. Last month I was thinking that I would run out of detergent pods, but I still have three left. I’m still not buying detergent, because after the pods are gone, I’ve got two samples, and after that is gone, I’ve got laundry sheets, and after laundry sheets are gone, I’ve got washing soda, and after washing soda I’ve got soap nuts. So I won’t be too surprised if next time I need to buy laundry soap comes around in 2025.

5. I rounded up all my instant noodles on one shelf, and although I don’t have an exact number, it looks like there’s at least 20 packs. As we’ve established above, I can’t have them daily, so ramen became a delicacy that I enjoy on Saturdays. It sounds ridiculous I’d wager, but I LOVE cup noodles/ instant ramen/ ramyun/ etc. It’s a thing I look forward to, and it gives me a decent dopamine boost, thus distracting me from desire to spend money. I’m thinking of pushing ramen to Sundays and bringing back cereal Saturdays. I used to eat cereal and watch Elementary on Saturdays, and it was a nice ritual.

Anyway, since there are at least 20 packs, I’m set for a couple of months without additional expense.

6. I spent 0 on fixing my car situation (and I hope I did not just jinx it). I charged the battery from my father’s car, put air in my tyres using my compressor, and was good to go. The only thing I paid for was car wash, but I went to an automatic one and spent 5 euro, instead of going the usual route of human labour and detailing and paying at least two times more.

7. I, er- OK, this sounds asinine, but I tipped less. Technically the only thing I had to tip for in April was over-the-counter coffee and a baked good – and the baked good I pick and pack myself. I also had to pay for grocery delivery once I think, because I was sick and at home – or was that in March… I don’t remember, but that I tipped well as I usually do, because these bags were heavy as fuck, and I live up some flights of stairs in a building without a lift. Coffee in a bakery, though, is a different matter. All I did was leave 1 or 2 instead of 5 or 10 as I would otherwise, because hey. Coffee costs 35. Baked things like I said I pick and pack myself. So all I did was tip proportionally instead of greatly over-tipping like I usually do.

I should extrapolate, I think, and mention that the ladies pouring my coffee are salaried workers. They have a fixed salary, and also a percentage of the entire amount they sell on that day. So they are not reliant on tips alone for their income.

But the narcissist in me will gladly return to overtipping the moment she can. She just can’t right now.

8. I used the things I had at home for my journalling. I wanted a tag system for my book journal so I could easier find certain things, and I thought of buying stickers, because I’ve seen people do the sticker system, and it looks very nice. But I went with what I have and used markers instead. I also used colour pencils for my tracker instead of buying colourful pens like I originally wanted.

9. My food waste, although present, was much lower this month. The amount I will be satisfied with is zero, though.

10. I used weaker medication for very minor headaches. As someone who lives with migraines, my first impulse is to always take a stronger pill so that a small headache has no chance of turning into a full blown migraine episode. But thankfully – well… – after years of coexisting with headaches I am quite proficient in differentiating headache types and knowing which one will turn into a migraine if not treated with stronger medication, and which one will just annoy me a bit longer but won’t render me useless for a day or two. It is not a practice I recommend. Take your meds, and don’t skimp on them. But I do what I have to do for now, and it did save me an estimated 10 to 20 euro.

11. Speaking of meds, I stopped taking supplements for insomnia – because I ran out of them and I had no money to replenish, and I hope I did not just jinx myself, but so far, so good. I still take all my main meds, though, but as it often is, main meds are cheaper than fancy supplements. When summer is in full swing I might have to go back to them, but for now I’m saving another 20-30 euro.

12. I’m drinking tea I swore I’d never drink again. And- I like it. They must have changed the leaves, because I promise it used to taste like paper. Now it tastes like a honey infusion. Anyway, so I had an unopened box at home for reasons I cannot begin to tell you, because I honestly have no idea. But I ran out of Lipton – which I, too, swore I would never drink again… – and I couldn’t find any other black tea but this box. So I was like, fuck it, I want tea, let’s try it. And I did. And I liked it. So next time I run out of tea, I’ll buy a 100 pack of this stuff.

Maybe it tastes different because the box says ‘high grown’ instead of ‘ceylon’. I am not sure how much truth is there in their marketing tricks, but it does taste different.

13. I stopped myself from ordering take-out dessert by making chocolate mug cake at home. There was nothing sweet at home, and I was very, very close to getting a cake delivered, but I fixed myself a microwave mug cake, and it was enough.

14. I bought the cheapest ice cream. Still tasty.

15. I ran out of but didn’t immediately buy a new jar of instant coffee. I’m not a big instant coffee drinker these days, but I do keep low-caffeine instant on hand for dalgonas and stuff (because those two heaping tablespoons of non-decaf will send me running for the hills). Well, I ran out, and I haven’t bought a new one. No more dalgonas for me. Whenever I want a late-night coffee, I just make one in a moka pot using my decaf Lavazza.

16. I don’t drink my morning coffee at home. Rather, I wait until I get to work and have it at the office for free. (Well, I still buy my own milk, as I am not a fan of powdered creamer.) Pretty sure this also helps keep my cortisol a little lower, as it takes me about an hour to make it to work after waking up, which means I don’t drink coffee first thing, as I’ve been doing since… age 10, I think.

17. And I suppose the biggest thing I did in April that will affect all the upcoming months is I negotiated a raise. Even with said raise I’m discouraged for June already – but how much more discouraged would I be without it? So of course I’m happy I will be getting more money each month. I just really need to continue reducing expenses as well.